I update each Saturday with my view of the stock market for the next few weeks. The monthly “Long Term” update will be on a Wednesday soon after the 15th of each month, and this supports investors who want to buy and hold, but want to sell to avoid the bulk of a crash, and buy back in for most of the next bull market. You can always scroll down a few weeks and find the latest “Long Term” update.

This week in the Geo-Political section, I put my thoughts on the risk to the economy as the Fed begins to shrink their balance sheet. If you think I have any inkling what is going on with the economy, this is “must read”.

If you would like to be notified via email when I post a new blog entry, you can “Follow” my blog by clicking on the Follow button at the bottom right hand corner of your screen. You may have to scroll up or down a bit for it to appear, but click on it and enter your email address. You do not have to have a wordpress account to follow a blog.

Economy:

ISM’s manufacturing index, already running well beyond strength in factory data out of Washington, is accelerating even further, to an index of 60.8 in September which is a 13-year best. Orders and employment continued to rise through September in ISM’s non-manufacturing sample which is showing no worrisome effects from Hurricanes Harvey and Irma. The headline index jumped to 59.8 for the highest score in more than 3 years. Crude oil inventories fell by a larger-than-expected 6.0 million barrels in the September 29 week to 465.0 million, 0.9 percent below the level a year ago. Hurricane impacts appear to be fading as initial jobless claims fell 12,000 in the September 30 week to 260,000 which hits Econoday’s low estimate. Increasing strength in capital goods is the good news in today’s factory orders report where a headline 1.2 percent gain is 2 tenths above Econoday’s consensus.

The Department of Labor can’t quantify September’s hurricane effects on payrolls or the unemployment rate but they appear to be very dramatic nonetheless. Nonfarm payrolls were negative in September and, at minus 33,000, were well below Econoday’s low estimate. But the big surprise in today’s report are sudden indications of excessive labor market tightness as the unemployment rate fell 2 tenths to 4.2 percent and average hourly earnings spiked 0.5 percent with the year-on-year rate jumping 4 tenths to 2.9 percent.

All systems are go. Hurricane affects aside, with the unemployment rate falling to 4.2% and hourly earnings up at .5% (that’s a 6% annual rate), it looks like the Fed will remain on target for a Dec. rate hike, and the 3 more rate hikes next year.

Geo-Political:

This is not geo-politics. It will be a rambling discussion of my view of the big picture. Buckle your seat belts.

Let’s go back to 2008 and the crash of the financial markets. Don’t worry about why it happened, that has been hashed over and over. Just think about what happened in the aftermath, and where that leaves us going forward. The way the big banks worked, particularly the investment banks, is the borrowed short term money (lower rates) and lent long term money (higher rates), and lived on the spread. With all the toxic mortgage backed securities out there in 2008, and lenders not knowing the credit quality of what was in a bank’s “book” of assets, they refused to roll over the short term debt of the big banks, making them insolvent. At this point, the government stepped in the Troubled Asset Relief Program (TARP) and they recapitalized the banks and wiped out the existing holders of the common stock. That got us by the initial danger. However, Bush’s final deficit was $1 Trillion in 2008, not counting the $700 billion TARP that he signed in early Oct. and put that debt on Obama’s first year. The structural deficit appeared to be $500 billion a year that Bush handed to Obama. That is because the 2001 ($110 billion per year) and 2003 ($60 billion per year) tax cuts never paid for themselves, and the $300 billion annual increase in defense spending, and the $50 billion annual expense of the Medicare Part D drug coverage program that there was no tax to cover. Obama added the Stimulus spending at $300 billion per year for 3 years, so the deficit was running close to $1 trillion per year for 3 years, then began to come down back to the former structural level of $500 billion per year.

The government had to sell bonds to get the cash to pay for those programs. In the middle of a great recession, who was going to buy all that US debt, running at $1 trillion per year? Certainly not corporations, and not individuals either. If the individuals had bought US government bonds, they would not have had money to go eat out, buy Air Jordans, or buy any consumer goods that kept the economy humming. The final option was that the government would buy its own debt, so the Fed printed some money up, and in the Quantitative Easing program, they bought mortgage backed and government bonds and held them on the Fed’s balance sheet. They bought long and short duration bonds, and when the short duration bonds matured they rolled that money and bought more bonds so the size of the Fed’s balance sheet remained the same. The Fed’s balance sheet is around $4 trillion dollars, quite huge. Now the Fed is going to start unwinding their balance sheet, so when bonds mature, about half will be reinvested in bonds, but half will not, and the private markets will be expected to buy the bonds. We are beginning to see longer rates tic up already, and that is probably a good thing. Rates are normalizing. It will be a good thing, until it is not, but it is also debatable whether it will turn dangerous to the economy.

Here is the big potential RISK to the economy. It is one thing for the Fed to buy a 30 year bond that yielded 2.2% interest annually for the next 30 years. They don’t have a family to feed and if it turns out to be a bad investment, they can always just print some more money. That is not true in the private market where corporations and individuals buy bonds. We look at the investment value of the bond, its ability to generate a yield that is attractive to all the other investment options we have, at a risk profile we are comfortable with. But, we all know that when interest rates rise, the value of bonds issued at lower yield levels will fall. That is investment risk.

If we know that interest rate increases are coming and the value of the underlying bonds will fall, why would I go out and buy a longer term bond? The answer is that I would not; I would wait until the yields had risen.

That is the RISK to the economy, a sudden rise in interest rates when consumers realize what is happening. A sudden rise in interest rates is bad for many reasons. It increases borrowing costs for business which will reduce their profitability which drives their stock prices. It would discourage plant expansion or equipment modernization, slowing the economy. It would make it harder for individuals to buy goods, particularly large expensive purchases like cars and homes. The value of the dollar would spike as international investors flock to our bond market to lock in attractive yields, which would make our goods more expensive in international markets, at least until the stock market began to crumble due to flagging profits.

So, is that scenario going to happen? I don’t know. The Fed will try mightily to not let it happen. While the Fed has a lot of power, at the end of the day, the rest of the world has more power. The Fed is moving very slowly with these quarter point rate hikes 3 times per year. Can they hold all the water behind the dam and not have the dam break? We’ll see.

What should you do? I have not bought a bond since 2009 as the yields were simply too low for me. I have not recommended bonds, especially bond funds (even short term bond funds), nor even balanced funds that hold a mix of stocks and bonds. A little bit of gold is a safety hedge, although the government bought gold from private hands during the great depression. https://en.wikipedia.org/wiki/Gold_Reserve_Act

The main thing you can do is be aware that we suffered a financial system crash in 2008, the Fed and Congress both played a long term game and manipulated markets to prevent a depression, and that risks remain as the Fed ends the manipulation of the financial markets, directly in the bond market and indirectly in the stock market. The Fed is just beginning to normalize their $4 trillion balance sheet, and we’ve never done this before!

Technical Analysis:

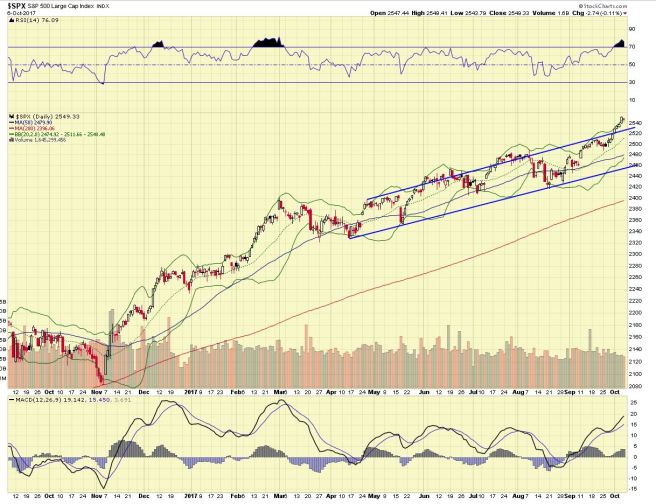

It was a good week for the market, with the major averages setting new record highs. From a trading perspective, now is the time to think about when to sell, since it is too late to buy. The market is already overbought, with the RSI at 76 (top of chart, 70 is overbought). The market can push higher, but the odds favor a pullback soon. MACD (momentum) is rising strongly in full bull mode. I was buying a few weeks ago on the 1% pullback, so this week I sold about 1/3 of my holdings, locking in some profit. I’ll keep a sharp eye out to sell remaining holdings before the next pullback. Experience says that with RSI up at 76, we’ll get a pullback in the near future.

Pullbacks have been very shallow and with the bull market remaining in effect, as a trader one must jump back in quickly (buy the dips). Seasonally we are entering the better half of the year as all the earnings forecasts for next year will be the best that they will be all year. That may not happen, but people will buy the forecast because it makes them feel good. I prefer to look at the actual earnings, as the forecast is just a story, and many times we see through the year that companies reduce their earnings forecast.

We’ll start earnings next week, and Factset expects earnings to be up 4% this quarter. Stocks will have the weak dollar supporting them. With strong economic activity the odds favor continued normalization of rates (higher rates) so bank stocks have risen. When rates rise, banks can increase their margin between what they pay to depositors and charge to borrowers, which increases their profit.

If you enjoy these updates, please tell your friends and family who are interested in the stock market about this blog.

Your comments and questions are always appreciated, so feel free to comment using the “Leave a Comment” feature just under the title of the post!

Rich Comeau, Rich Investing