I update each Saturday with my view of the stock market for the next few weeks (if occupied with family or travel, rarely I am a day or two late, just check back). The monthly “Long Term” update will be on the first Wednesday of each month, and this supports investors who want to buy and hold, but want to sell to avoid the bulk of a primary bear market, and buy back in for most of the next bull market.

If you lose your bookmark to the blog, google “Rich Investing Blog” and it should show up on the first page or so.

This is the post for the week (Wednesday 6/26), there will be no post on Saturday.

Economy:

The Case Schiller home price index of 20 cities was up in April Y-o-Y, 7.2%, too high. The Conference Board consumer confidence index slipped very slightly in June to 100.4, buoyed by confidence in the labor market. New home sales in May were 619K annualized, down substantially from April.

https://www.cnn.com/2024/06/26/economy/us-new-home-sales-may/index.html

Friday June 28th will see PCE reported for the month, which is the inflation guage the Fed favors, so keep an eye out for that on Friday.

This glimpse of the economy shows it remains sluggish, which is required to bring inflation down. Inflation in home prices is still too high.

Geo-Political:

Today, a quick look at Europe:

“May 20th 2024 – There is only one problem with chatter about Europe’s “soft landing”: its economy never truly flew. Whereas America’s growth has consistently amazed, Europe’s has been miserable. Exclude Ireland, where statistics are distorted by multinational firms minimising tax, and the EU’s GDP has risen by about 3% since 2019, compared with a 9% increase in America.

Yet Europe’s outlook is undoubtedly improving. Data published on May 15th show that the euro zone grew by 0.3% in the first quarter of this year against the previous quarter. This was the first significant growth in six consecutive quarters and enough for the currency bloc to emerge from a recession. The same day the European Commission upgraded its forecasts for EU growth. “We believe we have turned a corner,” cheered a commissioner.”

The rest of the article requires a subscription. A healthier Europe will be a better trading partner and support the US economy.

Technical Analysis:

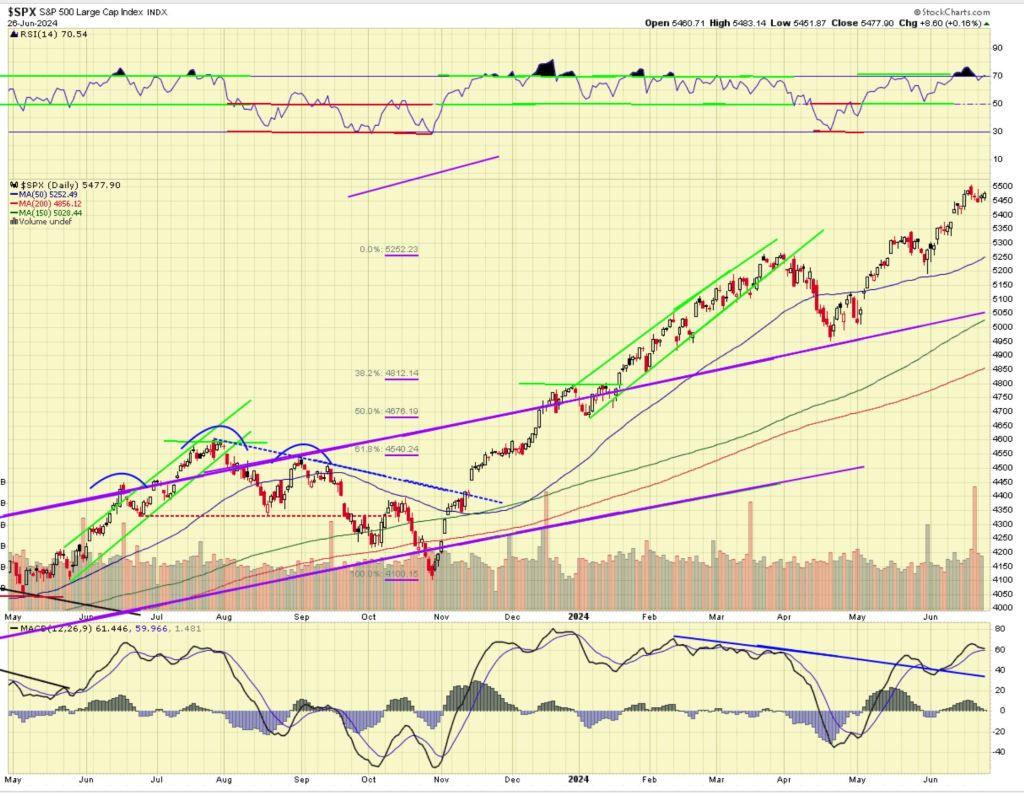

For the mid-week ending 6/26/2024, the S&P 500 was basically flat.

Technically (see chart below) the market looks positive. RSI at the top of the chart is overbought at 70 and steady. Momentum shown by MACD at the bottom of the chart is neutral and moving sideways and the histograms have shrunk to zero which is neutral (the histograms represent the distance between the two lines, the two moving averages). The price action is positive.

We’re in a bull market, and in a bull market when it gets overbought it can get more overbought. But it also has the risk of a correction from overbought.

Click THIS LINK to open the chart in a separate window.

What am I doing? I was looking for some things to sell near the all-time high. I took a short term profit in TOST, which sells a restaurant point of sale system that is gaining popularity. TOST is near its 52-week high. I bought a little MRNA which has corrected 25% after it ran up on some good news about a drug trial, but the product is probably 2 years from FDA approval. I reported in late May that I sold MRNA on the run-up. When a drug company pops up because of a successful trial, but other trials lie ahead and no revenue will come from that drug for a long time, I sell on the pop and will buy back on the drop. MRNA may not be finished correcting down. If the market goes into a general correction, MRNA would probably go lower with the market. So, I just bought a little and if the market corrects and MRNA corrects some more, I will buy more at the lower price.

———————–

I would like to call your attention to a page of my blog called “CLASSICS”. It is located at the top of the blog, on the banner just under the title. The banner has links to “Home”, “About”, and now “Classics”. These are articles that I wrote one time for the blog, but they are valuable insights at all times for investors.

There are currently 3 Classic topics posted: 1) Is it a bull market or a bear market? 2) Why does healthcare cost so much? and 3) Implications of a large national debt. (posted August 2022)

You can use the hyperlink below the chart of the S&P that will open a larger picture of the chart in a separate window. If you bookmark the link to the chart you can look at it each day of the week to see how the market is progressing to certain milestones. The picture in this post is a static .jpg so it does not update.

I am a retired person and preserving capital and seeking income are important objectives for me. I also want a growth component to my portfolio, while minimizing major risk. My style of investing will not suit everyone. I like to sleep well at night. Investing involves risk, including the risk of loss.

Rich Comeau, Rich Investing