Once a month, on the fourth Thursday of the month, I will put up a long term view of the market. This is provided for investors who don’t want to trade secondary swings in the market, but would like to exit the stock market relatively soon after a bear market begins, or enter the market after a new bull market begins (change in the primary trend). In the blog, they will always have a title called “Long Term (month) (year)”, so you can use your browser “Find” function and easily find them.

Economics:

GDP – The second estimate of 2023 Q4 GDP is +3.2%, following Q3’s +4.9%.

That is a warm read, well above the long term 2.0% trend. By itself, it would not prompt the Fed to hike the Funds rate, but it would push out the estimated time for the first easing.

This is bullish for the stock market.

| Year | Quarter | GDP % |

| 2023 | Q4 | 3.2 |

| 2023 | Q3 | 4.9 |

| 2023 | Q2 | 2.1 |

| 2023 | Q1 | 2.0 |

| 2022 | Year | 1.0 |

| 2021 | Year | 5.5 |

| 2020 – Covid | Year | 0.1 |

| 2019 | Year | 2.3 |

| 2018 | Year | 2.9 |

| 2017 | Year | 2.6 |

| 2016 | Year | 2.0 |

Fed interest rates – At the January meeting, the Fed left the Fed Funds rate unchanged at 5.5%.

After being balanced in the Fall meetings, the Fed indicated that future hikes are likely over. Powell said they will be cautious about timing the first rate cut. The bond market pushed out its timing of the first rate cut to June, with 3 cuts in 2024.

The other thing the Fed is doing is Quantitative Tightening (QT), which means they are not buying bonds to replace those that they hold when they mature, and outright selling bonds into the secondary market. The Fed continues to reduce its balance sheet by $90 billion per month and they have not indicated that they will end QT anytime soon. This provides a constant supply of bonds in the marketplace and the market may have to offer higher interest rates to entice people to buy those bonds. Are we seeing that in action right now, with rates backing up? The treasury also sends a constant stream of bonds to the marketplace to finance our obscene deficit.

Local and regional banks have tightened lending standards making it harder for small and medium businesses to get loans to expand. That will slow the economy down somewhat.

The latest CPI was +3.1% versus a year ago. The 30 year fixed mortgage has ticked back up to 7.4% as the whole interest rate complex moved up a little, since the Fed indicated a slower pace of rate cuts this year.

Fed policy is restrictive for the economy, and bearish for the stock market. But we are probably at the peak of interest rates, we have been on pause, and the next move appears to be down. That will eventually be good.

| Date | Fed Funds Rate | 5 Year Treasury | 10 Year Treasury | 30 Year Treasury |

| Feb 2024 | 5.5 | 4.3 | 4.3 | 4.4 |

| Jan 2024 | 5.5 | 4.0 | 4.1 | 4.4 |

| 2023 Q4 | 5.5 | 4.4 | 4.4 | 4.5 |

| 2023 Q3 | 5.5 | 4.4 | 4.3 | 4.4 |

| 2023 Q2 | 5.1 | 3.8 | 3.6 | 3.9 |

| 2023 Q1 | 4.7 | 3.8 | 3.6 | 3.8 |

| 2022 Year | 2.8 | 3.1 | 3.1 | 3.2 |

| 2021 Year | 0.2 | 0.8 | 1.4 | 2.0 |

| 2020 Year | 0.4 | 0.6 | 0.9 | 1.6 – Covid |

| 2019 Year | 2.2 | 1.9 | 2.2 | 2.6 |

| 2018 Year | 1.8 | 2.8 | 2.9 | 3.1 – Tax Cut |

| 2017 Year | 1.0 | 1.9 | 2.3 | 2.9 |

Valuation:

S&P 500 earnings – Factset shows that as of Feb. 16, for Q4 of 2023, the blended (79% actual, 21% estimated) year-over-year earnings increase for the S&P 500 is +3.2%. It appears we have exited the “earnings recession” of 2023.

The forward PE for the S&P is 20.4 (up from 19.5 last month) compared to the ten year average of 17.7, but remember, the forward PE is just a guess.

The 12 month forward “operating earnings” estimate on the S&P 500 from the Standard and Poor’s company is $240, unchanged from last month.

The Factset earnings estimate for 2024 Q1 is +3.9% (down from +5.4% a month ago) and their estimate for calendar year (CY) 2024 is +11% (down from 12% last month). Earnings estimates in 2024 will have an easy comparison of year over year since the 2023 numbers were negative in Q1 and Q2 of 2023.

I made a point to contrast what future earnings estimates from Factset are compared to last month, and there is quite a big difference. Telling the future is hard. Why do I even bother to report future estimates of earnings? Earnings (profits) drive the stock market. I look to the pro’s for their estimates, then I take them with a grain of salt. Even if the estimates turn out to be wrong, that is the data that the stock market is trading on today. It’s the best we have, and it may be wrong by a little, or sometimes a lot.

The outlook for earnings is bullish at +3.2% for Q4.

PE on S&P 500 – The current 12-month trailing GAAP PE on the S&P 500 is 26.8, up a bit from 25.7 last month. I used 4 quarters of earnings with the most recent being Q4 2023. The S&P rallied upward since Nov. 2023, faster than earnings growth, so the valuation rose.

This metric is significantly overvalued relative to my trimmed 30 year average of 19. I trimmed out the quarters during recessions for my 30 year average, since the P/E behaves very abnormally during those times. I go in 5 point increments for my terminology, so 20 – 25 would be moderately overvalued, while 25 – 30 would be significantly overvalued. Above 30 would be dangerously overvalued. On the downside, I will go with 14-18 being moderately undervalued and 9-13 being significantly undervalued. As a last resort, I will go with 4-8 as being egregiously undervalued, and hope we never see that because all investors will be in pain at that point.

This indicator is bearish.

Age of primary move, bull or bear market – This bull market is 17 months old, started in Oct. 2022. The age is neither bullish nor bearish, but it is worthwhile to keep it in mind.

Geo-Political: (No change this month)

Liquidity: Central banks globally raised rates to fight inflation, but most are pausing their interest rates. Inflation appears to be coming under control, but it is not where the central banks want it. They appear to be on pause to see if the hikes already in place will slow inflation to the target without additional hikes.

US / China: It appears that the US and China are engaged in a tug of war to see who is the world’s economic leader. China has advantages in low cost labor and some natural resources such as rare earth metals, but they lack oil and natural gas. China developed the ability to produce advanced electronics with the aid of the US, but the primary market for those items is the US and Europe. The US has long been a technology leader and we have sophisticated financial markets that are usually well regulated. Another major factor is global alliances. The US has strong alliances with NATO, Canada, Japan, and S. Korea, while China has a strong relationship with Russia.

The economy in China is slowing more than their government would like. Trade tension with the US contributes to the distress since US corporations are expanding outside of China, notably in Vietnam and India. The Chinese govt. has been hostile to free market activity by their own corporations such as Alibaba and Ten Cent. Their real estate sector was over leveraged and is in trouble.

Ukraine: Thewar in Ukraine drags on. Ukraine is having more success on the battlefield than most expected, with the help of western weapons. Russia is destroying much of eastern Ukraine’s cities and rebuilding will be difficult. Sanctions against Russia are disrupting commodity markets since Russia was such a large exporter or oil, natural gas, and metals. Ukraine was a large exporter of wheat and other foods and that export is hindered by the war. It appears that after the initial shock in the commodity markets when Russia invaded, prices have stabilized and the world is dealing with new sources and trading patterns.

Middle East Conflict: Hamas launched a violent attack on Israel on Oct. 7, 2023 using missiles and ground forces and Israel has responded with bombings inside Gaza. It’s a mess, but impact to the US economy is not noticeable. The Houthi rebels in Yemen are firing missiles at shipping in the Red Sea, causing many ships to go around Africa to Europe instead of using the shorter Suez Canal. That will increase wait times and raise transportation costs.

US National Debt: (added Sept. 2023) The US national debt is very large at over $34 trillion and it is growing too rapidly. I have been concerned about it since early in this century. If there is too much new debt and investors don’t want to buy the bonds that the US issues to fund the deficit, they may have to keep the interest rates high, particularly longer term interest rates, high enough to attract bond investors. Companies will then have to pay higher rates to fund long term projects and that will cut into their profits. Consumers facing high interest rates will slow purchases. It is not a good situation for the economy.

Geo-politics is currently bearish, mainly due to the war in Ukraine and global central banks restrictive policy.

Technical:

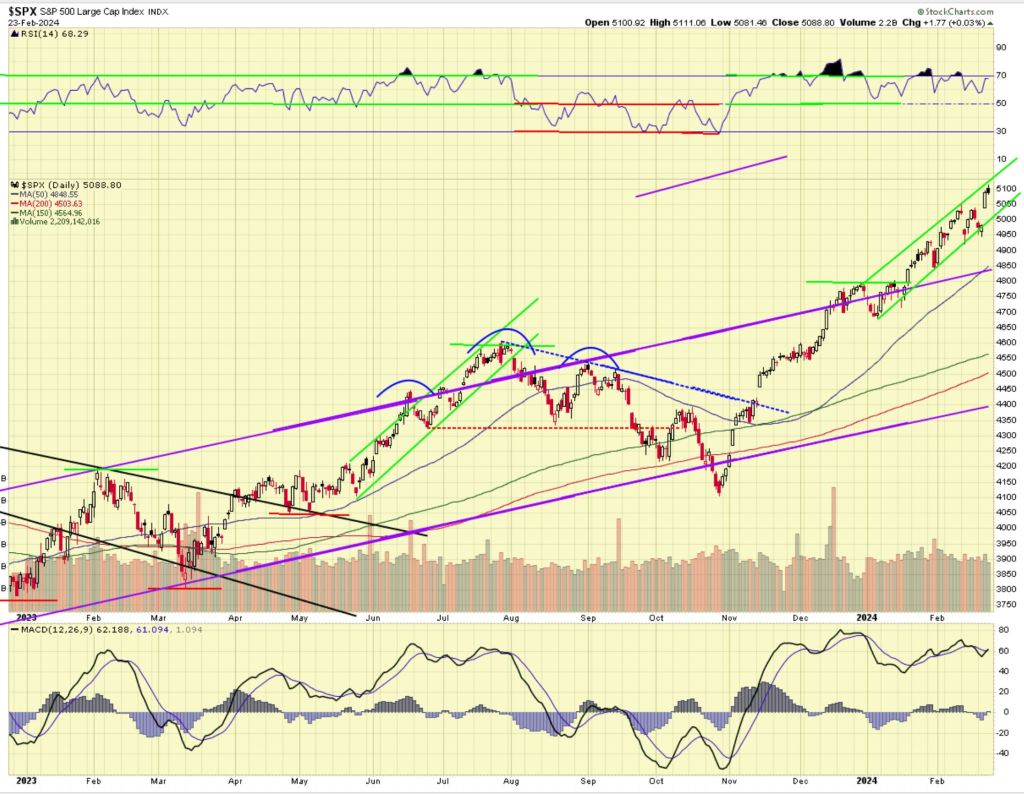

Technically the chart below is bullish near term (months), and still positive longer term (year).

RSI at the top of the chart is positive at 67 and rising. Momentum shown by MACD at the bottom of the chart is positive and rising. The price action is positive near term and positive longer term.

The price action is near the top of the long term up-channel, which will limit the upside probability from here. Resistance comes in when we hit the top of the channel (we don’t have to go that high) around the 5,000 level.

This close to the top of the up-channel, there is the risk of a correction. We can also go higher, above the top of the channel, like we did in 2021, but that was driven by excessive stimulus from the Covid cash infusion cycle from the govt. I don’t see that type of stimulus now, in fact the Fed interest rates are restrictive.

Ten Year Chart of the S&P 500

This is bullish in the short run, and remains bullish longer term.

Conclusion:

- GDP growth is bullish with Q4 GDP rising by 3.3%.

- The Fed has short term rates at 5.5%. That is restrictive and bearish.

- S&P earnings for Q4 are +3.2% above Q4 2022 which is bullish.

- The PE valuation of the S&P based on the 12 month trailing GAAP number is 26.8, which is significantly overvalued and bearish.

- The geo-political factors are bearish.

- Technically the chart looks bullish short term, and bullish longer term.

By that way of looking at it, the market is neutral, with three factors bearish, and three bullish.

Long Term Issues to Keep in Mind:

National Debt:

(January 2024) – The national debt is over $34 trillion.

(Late 2020) – The total national debt exceeds $26 Trillion, and as interest rates rise, the component of the annual budget allocated to “interest on the debt” will increase, putting pressure on existing programs, or increasing the deficit. If the deficit is allowed to rise too much in good economic times, the value of the dollar will fall and that is inflationary which is usually bad. The thing saving us today is how poorly all the other nations are managing their economies, so the dollar continues to hold up.

(Updated March 2020) – Covid 19 begins. Well this is going to get a lot worse. Looks like the politicians are going to be printing money and dropping it from helicopters. But all the other major economies will do the same thing, so relatively, the dollar may not drop much (which would be bad for inflation).

(Negative – Noted Jan. 2018) The deficit will go up despite the republicans saying that if the tax cut bill is “dynamically scored” using “possible” increases in economic activity, it will hold down the deficit by increasing tax receipts. This has not been shown to work in the past. The US added $980 billion to the national debt in fiscal 2019 (ended 9/30/2019), a tragedy in good financial times.

Rich Comeau, Rich Investing